Exploring the realm of web development for financial services unveils a crucial aspect of modern finance. This introduction sets the stage for a deep dive into the significance of digital presence in the financial sector, highlighting key features and functionalities that drive success in this competitive landscape.

As we navigate through the intricacies of web development tailored for financial services, we uncover the dynamic intersection of technology and finance, where innovation and user experience converge to shape the future of financial interactions.

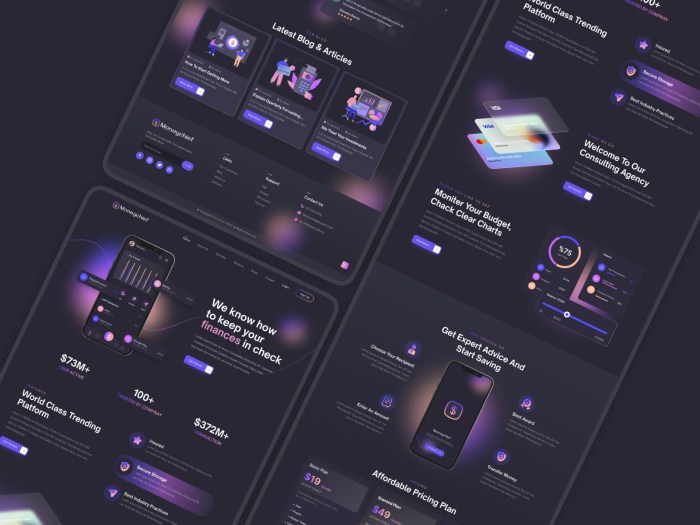

Web Development for Financial Services

Web development plays a crucial role in the financial services industry, providing a platform for institutions to connect with clients, offer services, and facilitate transactions in a digital environment.

Key Features and Functionalities

Key features and functionalities required in websites for financial services include:

- Secure Payment Gateways: To ensure safe online transactions.

- Account Management Tools: For clients to track their finances and investments.

- Mobile Responsiveness: To cater to users accessing the site on various devices.

- Financial Calculators: To help users with planning and decision-making.

Comparison with Other Industries

Web development for financial services differs from other industries due to the sensitivity of financial data and the need for strict security measures. While e-commerce sites focus on sales, financial websites prioritize data protection and compliance with regulations.

Successful Projects in the Financial Sector

Examples of successful web development projects in the financial sector include:

- Bank of America’s Online Banking Platform: Offering comprehensive services and a user-friendly interface.

- PayPal’s Secure Payment System: Revolutionizing online payments with advanced security features.

Mobile App Development for Financial Services

Mobile apps play a crucial role in enhancing financial services by providing users with convenient access to their accounts, enabling secure transactions, and offering personalized financial management tools on the go.

Role of Mobile Apps in Financial Services

Mobile apps have revolutionized the way customers interact with financial institutions. They allow for seamless account management, quick fund transfers, real-time notifications, and personalized financial insights. This level of accessibility and convenience has significantly improved the overall customer experience in the financial sector.

Challenges and Considerations in Mobile App Development

Security

Ensuring data encryption, secure authentication methods, and regular security updates to protect sensitive financial information.

Compliance

Adhering to regulatory requirements, such as KYC (Know Your Customer) and data privacy laws, to safeguard customer data.

User Experience

Designing intuitive interfaces, optimizing app performance, and providing seamless navigation to enhance user satisfaction.

Integration

Ensuring seamless integration with existing banking systems, third-party services, and emerging technologies for a holistic user experience.

Security Measures in Financial Services Mobile Apps

Multi-factor authentication

Implementing additional security layers, such as biometric authentication or one-time passwords, to verify user identity.

End-to-end encryption

Securing data transmission between the app and servers to prevent unauthorized access or data breaches.

Regular security audits

Conducting periodic assessments to identify and address potential vulnerabilities in the app’s code and infrastructure.

Secure API usage

Validating API calls, restricting access to sensitive data, and implementing rate limiting to prevent API abuse or unauthorized access.

Innovative Mobile App Solutions for Financial Institutions

Example 1

Description of the innovative feature or service provided by the app.

Example 2

Description of another innovative solution implemented by a financial institution.

Example 3

Brief explanation of a unique feature that sets a mobile app apart in the financial services sector.

Software Development for Financial Services

In the realm of financial services, software development plays a crucial role in ensuring efficient operations and meeting the specific needs of financial institutions.

Software Tools in Financial Services

Financial services often utilize a range of software tools to streamline processes and enhance security. Commonly used tools include:

- Customer Relationship Management (CRM) software for managing client interactions and data.

- Accounting software for tracking financial transactions and generating reports.

- Risk management software to assess and mitigate potential risks in investments and operations.

- Trading platforms for executing transactions in the stock market and other financial markets.

Custom Software Development Process

Custom software development for financial institutions involves several key steps to ensure that the software meets the unique requirements of the organization:

- Requirement analysis to understand the specific needs and objectives of the financial institution.

- Design and development of the software tailored to the organization’s requirements.

- Testing and quality assurance to ensure the software functions correctly and securely.

- Deployment and implementation of the software within the organization.

- Maintenance and support to address any issues and make necessary updates or enhancements.

Benefits of Tailored Software Solutions

Custom software solutions offer several advantages to financial institutions, including:

- Greater efficiency and productivity by automating tasks and streamlining processes.

- Improved security and compliance with industry regulations through customized features.

- Enhanced scalability to adapt to the changing needs and growth of the organization.

- Increased competitive advantage by providing unique capabilities tailored to the organization’s requirements.

Role of Automation in Software Development

Automation plays a critical role in software development for financial services by reducing manual tasks, improving accuracy, and increasing efficiency. Automated processes can help financial institutions streamline operations, reduce errors, and enhance overall performance.

Cybersecurity in Financial Services

In today’s digital age, cybersecurity plays a crucial role in the financial sector to protect sensitive data, prevent fraud, and maintain customer trust.

Importance of Cybersecurity in the Financial Sector

- Financial institutions deal with a vast amount of confidential information, including personal and financial data of customers. A breach in security could lead to severe consequences such as identity theft and financial loss.

- Cyberattacks on financial services can also disrupt operations, leading to financial instability and loss of reputation.

Common Cybersecurity Threats Faced by Financial Institutions

- Phishing attacks: Cybercriminals often use deceptive emails or messages to trick individuals into revealing sensitive information.

- Ransomware attacks: Malicious software that encrypts data and demands payment for decryption, posing a significant threat to financial institutions.

- Data breaches: Unauthorized access to customer information can result in financial fraud and identity theft.

Best Practices for Securing Financial Services Websites and Applications

- Implement multi-factor authentication to add an extra layer of security for user accounts.

- Regularly update software and systems to patch vulnerabilities and protect against emerging threats.

- Encrypt sensitive data to ensure that information is secure both in transit and at rest.

- Conduct regular security audits and penetration testing to identify and address potential weaknesses.

Role of Compliance Regulations in Shaping Cybersecurity Measures for Financial Services

- Compliance regulations such as GDPR, PCI DSS, and SOX require financial institutions to adhere to specific security standards to protect customer data.

- These regulations help establish guidelines for cybersecurity practices, ensuring that financial services prioritize the protection of sensitive information.

Mobile Technology Trends in Finance

Mobile technology has been revolutionizing the financial services industry, bringing about significant changes in how banking, payments, and investments are conducted. The adoption of mobile technology has not only made financial services more accessible and convenient but has also opened up new opportunities for innovation and disruption in the sector.

Enhanced Customer Experience

- Mobile banking apps offering a seamless and user-friendly interface for customers to manage their accounts, transfer funds, pay bills, and access financial information on the go.

- Integration of chatbots and AI-powered virtual assistants to provide personalized recommendations and assistance to customers in real-time.

- Mobile wallets and contactless payment solutions enabling secure and convenient transactions without the need for physical cash or cards.

Digital Transformation of Services

- Robo-advisors and automated investment platforms leveraging mobile technology to offer algorithm-based investment advice and portfolio management services to a wider audience.

- Blockchain technology and cryptocurrencies facilitating faster and more secure cross-border payments and transactions through mobile apps.

- Peer-to-peer lending platforms and crowdfunding apps democratizing access to credit and investment opportunities through mobile devices.

Regulatory Compliance and Security

- Implementation of biometric authentication methods such as fingerprint scanning and facial recognition to enhance security and prevent unauthorized access to mobile banking apps.

- Compliance with data protection regulations and industry standards to ensure the privacy and confidentiality of customer information shared through mobile devices.

- Integration of real-time fraud detection and prevention mechanisms to safeguard against cyber threats and financial fraud in mobile transactions.

Future of Mobile Finance

- Augmented reality and virtual reality applications transforming the way customers interact with financial services, offering immersive and engaging experiences for banking, investing, and payments.

- Internet of Things (IoT) devices and wearables enabling seamless integration with mobile banking apps for instant access to financial information and transactions on connected devices.

- Emerging technologies like 5G networks and edge computing expanding the capabilities of mobile finance apps, allowing for faster speeds, lower latency, and enhanced performance for users.

Technology & Software Innovations in Finance

In the rapidly evolving landscape of financial services, technology and software innovations play a crucial role in shaping the future of the industry. From AI to blockchain, these advancements are revolutionizing the way financial institutions operate and interact with customers.

Impact of AI, Machine Learning, and Blockchain in Finance

AI, machine learning, and blockchain technologies are transforming the financial sector by providing more efficient and secure solutions. AI algorithms are being used for fraud detection, risk management, and personalized customer services. Machine learning enables predictive analytics and automated decision-making processes.

Blockchain ensures secure transactions, reduces costs, and enhances transparency in financial operations.

Software Innovations Revolutionizing Customer Experience in Finance

Software innovations such as chatbots, robo-advisors, and personalized financial management platforms are enhancing customer experience in finance. Chatbots provide instant customer support, robo-advisors offer automated investment advice, and personalized financial management platforms help individuals track and manage their finances efficiently.

Emerging Trends in Technology and Software for Financial Sector

Emerging trends in technology for the financial sector include the rise of open banking, cloud computing, and digital wallets. Open banking fosters collaboration between financial institutions and third-party providers to offer enhanced services. Cloud computing enables secure data storage and accessibility.

Digital wallets facilitate seamless and secure online transactions, catering to the growing demand for digital payments.

Networking Solutions for Financial Institutions

In the realm of financial services, having a robust networking infrastructure is crucial for ensuring seamless operations, secure transactions, and reliable communication. Financial institutions rely heavily on networking solutions to support their day-to-day activities and maintain the trust of their clients.

Importance of Robust Networking Infrastructure

A strong networking infrastructure is essential for financial institutions to handle the high volume of transactions, sensitive data, and real-time communication that are integral to their operations. Without a reliable network, institutions risk facing downtime, security breaches, and inefficiencies that can have serious consequences for both the institution and its clients.

- High-speed connectivity to support real-time transactions

- Secure data transmission to protect sensitive financial information

- Scalability to accommodate the growing needs of the institution

- Redundancy to ensure continuity of operations in case of network failures

Networking Challenges Unique to Financial Institutions

Financial institutions face unique networking challenges due to the high level of security and compliance requirements in the industry. These challenges include ensuring data privacy, preventing cyber threats, and meeting regulatory standards while maintaining high performance and reliability.

- Compliance with regulations such as GDPR, PCI DSS, and SOX

- Protection against cyber threats like phishing attacks and malware

- Ensuring data integrity and confidentiality to maintain client trust

Requirements for Secure and Efficient Networking in Finance

To meet the demands of the financial industry, networking solutions must prioritize security, reliability, and efficiency. Secure and efficient networking in finance requires advanced technologies, proactive monitoring, and continuous updates to stay ahead of potential threats.

- End-to-end encryption to protect data in transit

- Multi-factor authentication for secure access control

- Intrusion detection systems to identify and respond to threats in real-time

- Regular security audits and updates to address vulnerabilities

Examples of Networking Solutions for Financial Industry

Several networking solutions are specifically designed to meet the unique needs of financial institutions, offering features such as high security, low latency, and scalability. Examples of networking solutions tailored for the financial industry include:

- Virtual Private Network (VPN) for secure remote access

- Software-Defined Networking (SDN) for agile and efficient network management

- Blockchain technology for secure and transparent transactions

- Cloud-based networking for scalable and cost-effective infrastructure

Gaming Hardware Integration in Financial Services

In today’s digital age, the use of gaming hardware in financial services is gaining traction as organizations seek innovative ways to enhance customer experience and streamline operations. By leveraging the advanced technologies found in gaming hardware, financial institutions can revolutionize the way they interact with clients and manage their internal processes.

Enhancing Customer Interaction

- Virtual Reality (VR) Headsets: Financial advisors can use VR headsets to provide immersive experiences for clients, allowing them to visualize investment portfolios and financial data in a more engaging manner.

- Motion Controllers: By incorporating motion controllers, banks can offer interactive tools for customers to navigate through financial information and make informed decisions.

Streamlining Operations

- Gaming Keyboards and Mice: Financial analysts can benefit from the precision and speed of gaming keyboards and mice to efficiently analyze market trends and data.

- High-Performance Graphics Cards: Utilizing powerful graphics cards can accelerate complex calculations and data processing, improving the efficiency of risk management and trading activities.

Benefits and Limitations

-

Benefits:

Enhanced user experience, improved decision-making processes, increased efficiency in operations, and potential cost savings in the long run.

-

Limitations:

High initial investment costs, compatibility issues with existing systems, and the need for specialized training for staff to fully utilize gaming hardware.

Innovative Uses in the Financial Sector

- Interactive Financial Simulations: Banks can create gamified simulations to educate customers about financial literacy and investment strategies.

- Real-Time Data Visualization: Gaming hardware can be used to display real-time market data in a visually appealing and easy-to-understand format for traders and analysts.

Smart Technology Applications in Finance

Smart technology has revolutionized the way financial services operate, offering innovative solutions to streamline processes and enhance customer experiences. One of the key aspects of smart technology in finance is the integration of IoT devices and smart sensors, which play a crucial role in collecting and analyzing real-time data for informed decision-making.

IoT Devices and Smart Sensors in Finance

Smart sensors and IoT devices have transformed the financial industry by providing valuable insights into customer behavior, market trends, and operational efficiency. These devices enable financial institutions to gather data on transactions, customer preferences, and even environmental factors that can impact business operations.

- Smart sensors embedded in ATMs and POS terminals help detect fraudulent activities and ensure secure transactions.

- IoT devices in banking apps allow customers to track their spending habits, receive personalized recommendations, and manage their finances more effectively.

- Smart sensors in smart buildings and offices help optimize energy consumption, reduce costs, and create a more sustainable environment for employees and customers.

By leveraging IoT devices and smart sensors, financial institutions can enhance operational efficiency, improve customer experiences, and gain a competitive edge in the market.

Benefits of Smart Technology Adoption in Finance

The adoption of smart technology in finance offers a myriad of benefits for financial institutions, including:

- Improved data accuracy and real-time insights for better decision-making.

- Enhanced security measures to protect sensitive information and prevent cyber threats.

- Increased operational efficiency and cost savings through automation and process optimization.

Challenges in Implementing Smart Technology Solutions in Finance

While smart technology brings numerous advantages to the financial sector, there are several challenges and considerations to address when implementing these solutions:

- Ensuring data privacy and compliance with regulatory requirements to protect customer information.

- Managing the complexity of integrating various IoT devices and smart sensors into existing systems and infrastructure.

- Addressing cybersecurity risks and vulnerabilities associated with interconnected devices and networks.

Closing Summary

In conclusion, web development for financial services not only serves as a gateway to enhanced customer engagement and operational efficiency but also as a testament to the evolving landscape of financial technology. By embracing innovative solutions and staying attuned to industry trends, financial institutions can leverage web development to solidify their digital footprint and stay ahead in the ever-evolving financial services sector.

Q&A

What are the key features required in websites for financial services?

Key features include secure payment gateways, intuitive user interfaces, real-time data updates, and seamless integration with financial tools.

How does web development for financial services differ from other industries?

Web development for financial services requires stringent security measures, compliance with financial regulations, and integration with complex financial systems, setting it apart from other sectors.

Can you provide examples of successful web development projects in the financial sector?

Projects like Mint, Robinhood, and PayPal showcase successful web development tailored for financial services, offering innovative solutions and user-friendly experiences.